LeveragedBuyout

SENIOR MEMBER

- Joined

- May 16, 2014

- Messages

- 1,958

- Reaction score

- 60

- Country

- Location

http://blogs.ft.com/beyond-brics/2014/09/18/three-new-engines-of-growth-to-watch-in-china/

Three new “engines of growth” to watch in China

Sep 18, 2014 5:18amby Mian Ridge

00

China’s plan to spread the wealth of coastal cities into poorer interior regions is starting to pick up speed, with better transport infrastructure in particular likely to accelerate the process, according to HSBC Global Research.

While China’s coastal regions have seen breakneck growth – the nominal GDP of seven coastal provinces has increased nearly 200 times since 1978 – its vast inland areas, remote and undeveloped, have lagged behind. Per capita income in the coastal regions of China is twice as high as in inland provinces.

That disparity is now working to the inland provinces’ advantage, says HSBC in its note, China – growth spreads inland. Rising input costs have pushed manufacturers to find cheaper production bases; while some have moved to developing Asian countries, many are shifting inland.

The process is being hastened by government policy. The recent announcement of three “regional integration plans” shows how the focus of development has shifted to the interior, HSBC said. In the short term, it reckons, growth in these areas will be fuelled by increased migration and infrastructure upgrades; longer term, it will rely more heavily on supply side factors: labour, capital and technology.

China has been seeking to share the wealth of the coastal cities with poorer inland parts of the country for 15 years.This strategy has now received renewed impetus with the announcement of three regional integration plans designed to make growth more balanced.

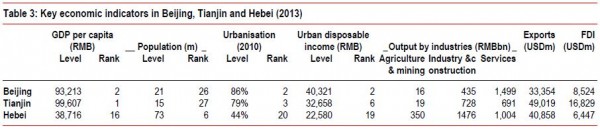

The plan for Beijing, Tianjin, Hebei – or Jing-Jin-Ji, an abbreviation of the Chinese names of those places, as it is known – aims to spread Beijing’s wealth to neighbouring areas. The hope is that this will ease overcrowding in Beijing and Tianjin, a big wealthy port city, while pushing up growth in Hebei, a relatively poor province known for heavy industry.

The plan for Beijing, Tianjin, Hebei – or Jing-Jin-Ji, an abbreviation of the Chinese names of those places, as it is known – aims to spread Beijing’s wealth to neighbouring areas. The hope is that this will ease overcrowding in Beijing and Tianjin, a big wealthy port city, while pushing up growth in Hebei, a relatively poor province known for heavy industry.

Progress had been made on several fronts, said HSBC, foremost among them the development of transport: more frequent, high speed trains and new highways. Beijing’s seventh ring road, due to be finished next year, would run through a number of Hebei cities. A second Beijing airport is also being built in Hebei.

Source: CEIC, HSBC. Click to enlarge

Some leading state-owned enterprises are being asked to move to Hebei. In June, it was announced that the three areas’ customs procedures were being integrated, easing the flow of goods.

Obstacles included uneven distribution of public resources and wage disparities – with Hebei being the loser in most cases – but:

We think the Jing-Jin-Ji area has the potential to become the most prosperous region in northern China, with Beijing and Tianjin devoted to the services sector and high-end manufacturing, and Hebei being the backyard workshop.

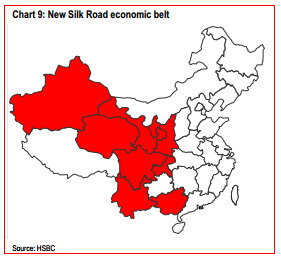

A second region under development is the New Silk Road economic belt, a revitalised version of the ancient trade route from China to Europe, which in China will involve nine provinces, five in the north-west and four in the south-east – an area that covers more than a third of the country.

The area’s biggest challenge, according to HSBC, is weak economic links between these regions. Despite government infrastructure projects, the area has underperformed: while its share of FDI was 18 per cent of the national total in 2013, its share of exports was only 5 per cent.

The area had comparatively low wage costs and land prices, however. In the next couple of years it would remain the focus of the central government’s investment in transport construction. Multiple pipeline are under construction and HSBC estimates that by 2020 natural gas imported from central Asia will constitute 40 per cent of China’s natural gas supply.

Related infrastructure projects as well as the construction of natural gas pipelines will support strong investment growth. Real GDP growth in this region will remain well above the national average and the gap with the coastal provinces will gradually narrow.

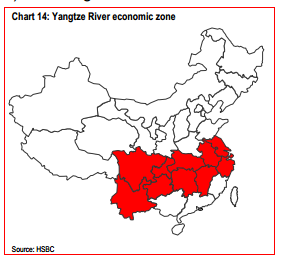

A third economic zone covers 11 provinces along the Yangtze River Delta, including Shanghai. River shippings’ comparative low costs, along with a cheap and plentiful labour force and a decent transport system make cities along the river ripe for investment.

The region has big economic disparities across its region: some highly industrialised, other left behind.

Other problems included disparities in social welfare benefits and business environments, which would hold back the free flow of labour and resources, and air and water pollution.

Still:

Three new “engines of growth” to watch in China

Sep 18, 2014 5:18amby Mian Ridge

00

China’s plan to spread the wealth of coastal cities into poorer interior regions is starting to pick up speed, with better transport infrastructure in particular likely to accelerate the process, according to HSBC Global Research.

While China’s coastal regions have seen breakneck growth – the nominal GDP of seven coastal provinces has increased nearly 200 times since 1978 – its vast inland areas, remote and undeveloped, have lagged behind. Per capita income in the coastal regions of China is twice as high as in inland provinces.

That disparity is now working to the inland provinces’ advantage, says HSBC in its note, China – growth spreads inland. Rising input costs have pushed manufacturers to find cheaper production bases; while some have moved to developing Asian countries, many are shifting inland.

The process is being hastened by government policy. The recent announcement of three “regional integration plans” shows how the focus of development has shifted to the interior, HSBC said. In the short term, it reckons, growth in these areas will be fuelled by increased migration and infrastructure upgrades; longer term, it will rely more heavily on supply side factors: labour, capital and technology.

China has been seeking to share the wealth of the coastal cities with poorer inland parts of the country for 15 years.This strategy has now received renewed impetus with the announcement of three regional integration plans designed to make growth more balanced.

Progress had been made on several fronts, said HSBC, foremost among them the development of transport: more frequent, high speed trains and new highways. Beijing’s seventh ring road, due to be finished next year, would run through a number of Hebei cities. A second Beijing airport is also being built in Hebei.

Source: CEIC, HSBC. Click to enlarge

Some leading state-owned enterprises are being asked to move to Hebei. In June, it was announced that the three areas’ customs procedures were being integrated, easing the flow of goods.

Obstacles included uneven distribution of public resources and wage disparities – with Hebei being the loser in most cases – but:

We think the Jing-Jin-Ji area has the potential to become the most prosperous region in northern China, with Beijing and Tianjin devoted to the services sector and high-end manufacturing, and Hebei being the backyard workshop.

A second region under development is the New Silk Road economic belt, a revitalised version of the ancient trade route from China to Europe, which in China will involve nine provinces, five in the north-west and four in the south-east – an area that covers more than a third of the country.

The area’s biggest challenge, according to HSBC, is weak economic links between these regions. Despite government infrastructure projects, the area has underperformed: while its share of FDI was 18 per cent of the national total in 2013, its share of exports was only 5 per cent.

The area had comparatively low wage costs and land prices, however. In the next couple of years it would remain the focus of the central government’s investment in transport construction. Multiple pipeline are under construction and HSBC estimates that by 2020 natural gas imported from central Asia will constitute 40 per cent of China’s natural gas supply.

Related infrastructure projects as well as the construction of natural gas pipelines will support strong investment growth. Real GDP growth in this region will remain well above the national average and the gap with the coastal provinces will gradually narrow.

A third economic zone covers 11 provinces along the Yangtze River Delta, including Shanghai. River shippings’ comparative low costs, along with a cheap and plentiful labour force and a decent transport system make cities along the river ripe for investment.

The region has big economic disparities across its region: some highly industrialised, other left behind.

Other problems included disparities in social welfare benefits and business environments, which would hold back the free flow of labour and resources, and air and water pollution.

Still:

Given all the advantages – strategic location, river transport and a strong industrial base to build on – we believe this economic zone will become the second most prosperous regional cluster in China, second only to the coastal regions.

In the past five years average GDP growth in most of the provinces in this region was above 12%. And by 2020 we think this area’s output should easily exceed 50% of the national total. Compared to other regional clusters, the process of moving industries should be smoother as many cities like Wuhan and Chongqing already have a good manufacturing base.

HSBC said that across all regions the government needed to facilitate the free movement of labour and capital: the recent reform of the household registration system, which gives migrant workers similar rights to urban residents was “a significant breakthrough”.In the past five years average GDP growth in most of the provinces in this region was above 12%. And by 2020 we think this area’s output should easily exceed 50% of the national total. Compared to other regional clusters, the process of moving industries should be smoother as many cities like Wuhan and Chongqing already have a good manufacturing base.

Another important development is the move to make social welfare benefits more equitable throughout the country. These are important elements of the forces helping to drive sustainable growth in China.