> Using trade surplus to judge a country's corporate competitiveness lmao.

1) Japanese companies don't manufacture just in Japan. A Panasonic product produced in Vietnam exported to Japan counts towards Vietnam's trade exports and Japan's trade imports, but the profit is accrued to Japan's current account. Japan's primary income from overseas is usually outstrips their trade deficit. That's why over the years Japan regularly incurs trade deficit but still manages to have large current account surpluses.

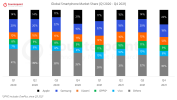

View attachment 886979

en.wikipedia.org

Higher oil price, weaker yen push up import bill

asia.nikkei.com

2) Trade surplus or current account surplus is a poor indicator of a country's corporate competitiveness. The US has the largest trade deficit but their companies are still among the most profitable and valuable in the world, and they are non-state owned.

Ranking the world's top companies by market cap, market value, revenue and many more metrics

companiesmarketcap.com

Ranking of the world's top publicly traded stock companies by earnings (TTM)

companiesmarketcap.com

Macau has a trade surplus. Does that mean they have better companies than the US?

Suppose the US experience a severe recession and wages falls, resulting in a contraction in consumer spending and imports. Does that mean that American companies produce better products now?

Chronic trade surpluses/deficits just means fundamentally there's a mismatch between domestic consumption and external consumption.