I can't but bring in an overall picture here. The amount government spends on bailing these loss making entities out, can be spend on a lot of other things. 6 billion or 2 billion rupees is a big amount. That too for just a few months. Imagine how much PIA has looted alone in the past 5 years. Would be enough to put JF-17 on track or purchase a couple of used F-16 squadrons (just putting in perspective)

very simple, PIA is giving jobs to over 18,000 people and ssame amount is given in pensions...how many people will be affected if JF-17 progrmme goes down..apparently none that is visible.

i will surprised if he can even privitze it.

we are all having misleading news in media to avoid such privatization, a clear cut loss making figures but yet the news title says profits

total loss making entites was 500 billion rupees last year slightly less than defence budget.

some major winners were electric compnies,Steel mills,PIA and railway

International media: WSJ acknowledges Pakistan’s privatisation vision

By APP

Published: January 25, 2014

Share this article

Print this page

Email

Spurred by a $6.6 billion loan from the International Monetary Fund, Sharif’s government in September 2013 committed to begin the privatisation process of more than 30 public energy, transport and infrastructure corporations over the three years. ILLUSTRATION: JAMAL KHURSHID

ISLAMABAD: Wall Street Journal has acknowledged Prime Minister Nawaz Sharif’s

vision to privatise Pakistan’s state-dominated failing enterprises and hopes that it will help the country overcome its economic crisis.

The paper stated that Sharif has the opportunity to deliver on a long standing promise of privatisation, after the country’s first transition from one elected government to another.

The paper mentioned the 49% rise in Pakistan’s benchmark stock index in 2013, and expressed belief that more economic good news will follow this year, if Sharif delivers on his privatisation promise.

In a write-up on its opinion page, ‘Pakistan Privatises for Growth’, Sharif’s chance to reform a state-dominated economy stated that though Pakistan faced numerous problems — from terrorism and lawless territories to power shortages and polio, privatising ‘state-owned dinosaurs’ was not the sole solution.

“But the sooner Islamabad can stop hemorrhaging Rs500 billion (nearly $5 billion) annually on budgets, subsidies and bailouts for failing enterprises, the better,” the paper said.

Spurred by a $6.6 billion loan from the International Monetary Fund, Sharif’s government in September 2013 committed to begin the privatisation process of more than 30 public energy, transport and infrastructure corporations over the three years.

These include Pakistan State Oil, Pakistan International Airlines and Pakistan Steel Mills. The process was being led by a 15-member privatisation commission headed by Mohammad Zubair, formerly IBM’s chief financial officer for the Middle East and Africa.

The paper hoped that the process will move forward with the expertise and political independence; starting with partial privatisation of Pakistan International Airlines by December.

ISLAMABAD: Criminal corruption and incompetence in at least eight public sector enterprises (PSEs) have gobbled down approximately Rs1,500 billion in taxpayersí money in a mere 48-month time span, The News shockingly learnt Monday.

Moreover, the losses figure is expected to cross the Rs2,000 billion mark by the end of the year, according to reliable sources.The unprecedented spike in losses ñ an accumulated consequence of brazen corruption and gross incompetence ñ is being blamed on the present government’s penchant for appointing lackeys and cronies to key posts in these public sector companies.

An official report on the financial losses and profits of at least eight PSEs available with The News including the power sector (Pepco), Pakistan Railways (PR), Pakistan International Airlines (PIA), Pakistan Steel Mills (PSM), Utility Stores Corporation (USC), Trading Corporation of Pakistan (TCP), Pakistan Agricultural Storage & Supplies Corporation (Passco) as well as the National Highway Authority (NHA), revealed that during the period 2007-08 to 2010-11, major losses incurred on account of power subsidies in all shapes amount to the tune of Rs1,100 billion.

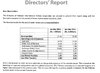

While the remaining PSEs have caused financial losses of Rs400 billion during the last four years, the report states that TCP and USC were profit making enterprises in the public sector during this period. Total losses of PSEs stood at Rs86.7 billion during the 2007-08 fiscal year with major loss incurred to PIA to the tune of Rs36.1 billion, Pakistan Railways Rs16.9 billion, Passco Rs3.4 billion and NHA Rs33.5 billion. Meanwhile, the profits earned by USC and TCP stood at Rs2.1 billion Rs1.1 billion respectively in 2007-08. However, the losses of PSM for 2007-08 are not available in the official report.

The losses of PSEs skyrocketed up to Rs90.8 billion in 2008-09 with a major burden on the national kitty because of losses faced by the Pakistan Steel Mills amounting to the tune of Rs26.5 billion, NHA Rs35.3 billion, Pakistan Railways Rs23 billion, PIA Rs4.9 billion and Passco Rs3.3 billion. The profits earned by USC stood at Rs0.5 billion and TCP Rs0.8 billion during fiscal year 2008-09.

The subsidies to PSEs consumed Rs90.8 billion in the 2009-10 fiscal year with major losses incurred by the NHA at Rs44.4 billion, Pakistan Railways Rs25 billion, PIA Rs20 billion, PSM Rs11.5 billion and Passco Rs13.8 billion. The profits earned by USC and TCP were Rs0.7 billion Rs1.6 billion respectively in 2009-10.

The losses of PSEs touched Rs101 billion in the 2010-11fiscal year as the financial burden of Pakistan Railways had eaten up approximately Rs31.1 billion of taxpayersí money. PIA losses in the first nine months of 2010-11 stood at Rs19.3 billion, PSM Rs11.5 billion, Passco Rs14.1 billion and NHA Rs36.5 billion. TCP profits, by comparison, stood at Rs1.4 billion during the 2010-11 fiscal year.

According to the official report, persistent poor performance of certain PSEs during the last few years is taking its toll on the fiscal picture. These colossal losses are causing serious impediments in achieving much needed fiscal consolidation and retarding economic growth. An analysis of the financial position of Pakistan Railways, PIA, PSM, USC, TCP, Passco and NHA reveals that most of them are incurring huge losses. The losses are persistently maintaining upward pressures as these stood at Rs113.2 billion in 2009-10 as compared to Rs90.8 billion in 2008-09.

The report states that energy outages are not only impeding the growth prospects but are taking a huge toll on the national exchequer in terms of huge subsidies to cover the tariff differential subsidy (TDS). The government has to pay Rs238.8 billion to cover inter-Disco (power distribution companies) tariff differential. Losses incurred by four Discos including Gepco (Gujranwala Electric Power Company), Mepco (Multan Electric Power Company), Pepco (Peshawar Electric Power Company) and Hepco (Hyderabad Electric Power Company) stood at Rs27.1 billion during 2010-11 ñ almost doubled from Rs14.5 billion in 2009-10.

The losses of these four Discos stood at Rs8.3 billion in 2006-07, Rs21.6 billion in 2007-08, Rs5.4 billion in 2008-09, Rs14.5 billion in 2009-10 and Rs27.1 billion in 2010-11. Now the government has envisaged a budget amount of Rs11.2 billion for these four Discos for the current fiscal year 2011-12.

The report stipulates that the government could have contained the fiscal deficit at 5.2 percent of the GDP if total subsidies had been kept within the budget target of Rs126.7 billion instead of a whopping amount of Rs380.6 billion in 2010-11.

According to the report, the government-formed Cabinet Committee on Restructuring (CCoR) which is entrusted with the task of addressing the fiscal maladies being confronted by PSEs due to poor performance needs to be addressed urgently by the restructuring of a roadmap for their improved economic governance.

The focus of the restructuring is to (i) improve overall corporate governance of PSEs (ii) curtail haemorrhaging: (iii) improve service delivery; (iv) reduce fiscal burden on the exchequer and (v) move to a structural surplus and increased public sector savings.

The report maintains that PSE reforms based on the foregoing contours will be helpful in spurring economic growth, attaining fiscal consolidation and setting aside resources for investing in critical areas like education, health, energy and road infrastructure. Moreover, it will abate pressure on borrowing for budgetary support and devise monetary policy to support private sector investment, the report concluded.

just take example of steel mills, have it not been knock down by supreme court govt would have saved atleast 130 billion rupees in direct revenues. another 2-3 billion dollars in taxes and foreign exchange saving earning, hell due to high imports of steel its possible we wouldnt have had a negative fiscal deficit!! and probably would have not needed IMF.

the only steel mills of pakistan is closed for now 5 years with zero running just paying off salaries of worth billions i think last year mere salaries were 8-12 billion rupees excluding pensios

not only did we lost the chance to give it to a local firm we also lost chance of investment and more importantly killed off any foreign investment afterwards..no reason why mushi wanted to get rid of him.

govt should close PIA if it cant sell it. period.

the amount spend could have been used establish and run a state of the art hospital in every district..thats what we need we dont need PIA there are dozens of pakistani and foreign companies to do so. look at air blue for example..

yes state companies are needed in some field to take the lead and encourage other entites e.g in thar coal these days or to build mega dams..but definetly not running loss making entites

.

.

itni ziada Urdu I cant read

itni ziada Urdu I cant read  Will take me too long can you please summarize

Will take me too long can you please summarize